Welcome to the second edition of the D2N2 Economic Recovery Report.

This report pulls together information from across the region to understand the impact of Covid19 on our economy.

For previous editions of the D2N2 Economic Recovery Report, please see below:

D2N2 Economic Recovery Report – July 2020

As part of its response to the Coronavirus, D2N2 is producing data reports examining how the Coronavirus pandemic has affected the local economy.

The report has been produced in collaboration with the University of Derby, the University of Nottingham, and Nottingham Trent University.

This latest report focuses on several key areas:

- D2N2 Economic Recovery Analytics Group

- D2N2 Growth Hub Survey Findings

- Furlough Schemes

- High Growth Businesses

- Education and Skills

- Midlands Engine Overview

A PDF version of this D2N2 Economic Recovery Report is available for download.

1. D2N2 Economic Recovery Analytical Group

The D2N2 Economic Recovery Analytical Group (AG) is drawn from the region’s universities, colleges, local authorities and business groups together with colleagues from Government.

It undertakes pro bono research and analysis to support planning and delivery by the LEP and the Derbyshire and Nottinghamshire Local Resilience fora.

The AG supports the work of our Economic Recovery Board, which leads the revision of our Local Industrial Strategy to become a Recovery and Growth Strategy. Recent AG work has included:

- Analysis of Covid-19’s sectoral impact and employment: Full report

- Covid-19’s impact on occupational classes: Data online | Full report

- Unemployment: Data online

- Recommending to local partners and government the creation of a youth employment and skills offer

Key tasks will now include:

- Ensuring that recent government announcements, for example the Kickstart Fund, are targeting where they will have most effect in our region.

- Providing advice on the development of the local level economic recovery plans commissioned by the LRFs.

- Developing a suite of economic indicators to help us monitor the progress of the recovery

2. D2N2 Growth Hub Survey Findings

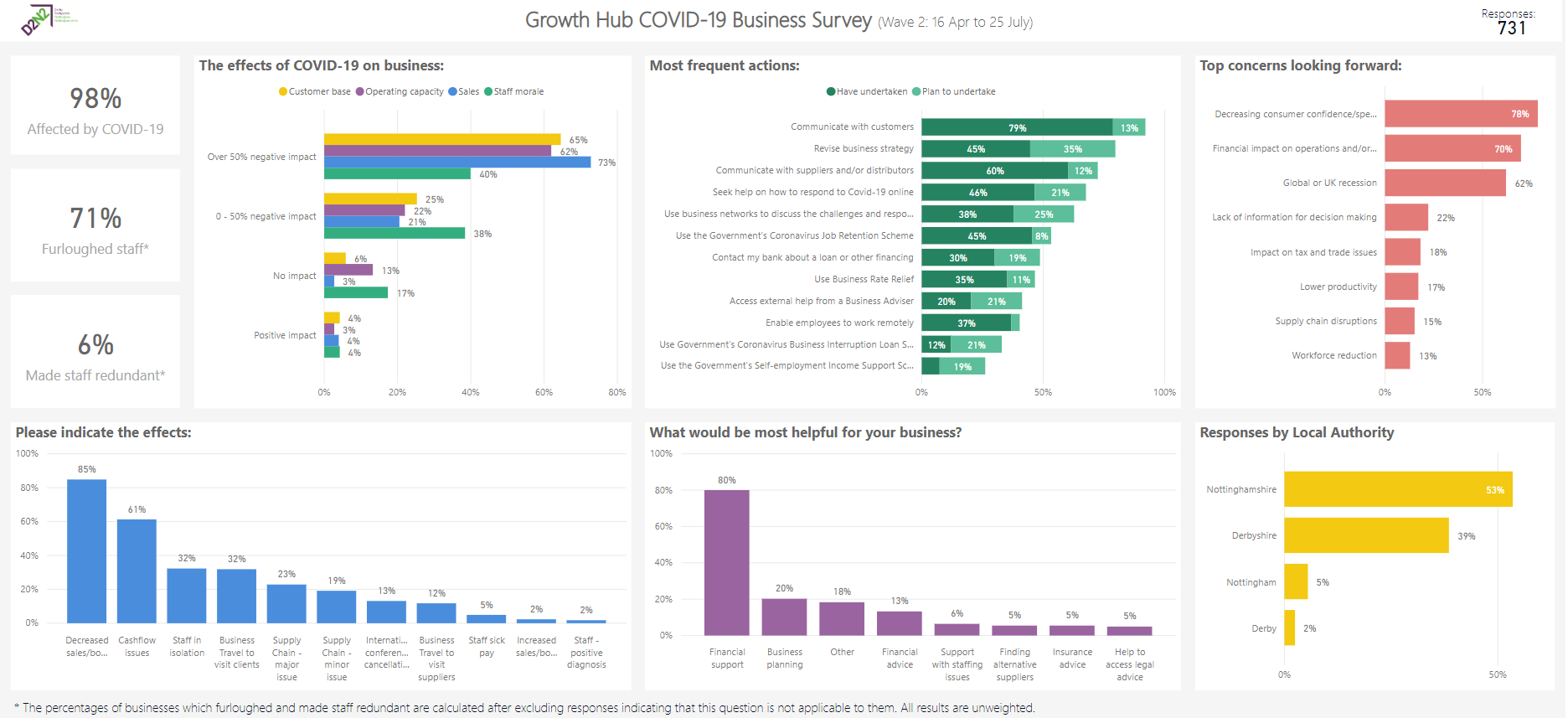

Working alongside business representative organisations and local authorities, a consolidated survey has allowed the collection of standardised business data to inform recovery planning. By 8 July, 777 business had responded to the D2N2 Growth Hub Survey.

- 97% of businesses said Covid-19 was affecting their business, the overwhelming majority in a negative way

- 71% of respondents furloughed staff, and 6% made staff redundant

- 72% of respondents have experienced over 50% decline in sales.

The survey will now serve as a baseline, and a new version will be issued shortly.

3. Furlough Schemes

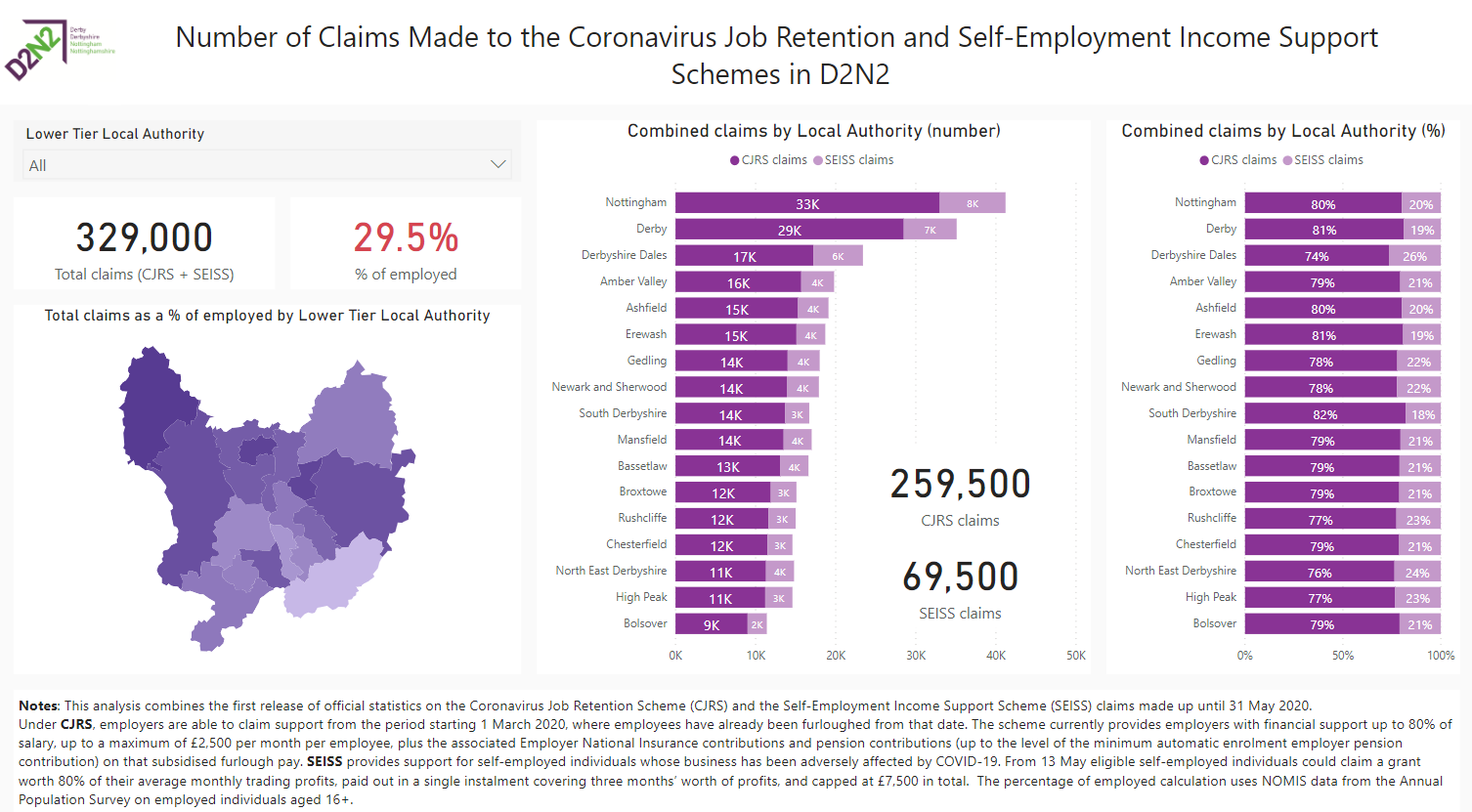

The first release of official statistics on the Coronavirus Job Retention Scheme (CJRS) and Self-Employment Income Support Scheme (SEISS) show that there were 329,000 claims made up until 31 May 2020 in D2N2 or 29.5% of all employed people before the crisis.

The highest percentage of claimants relative to the number of employees is Mansfield (32.4%), High Peak (33%) and Chesterfield (32.5%).

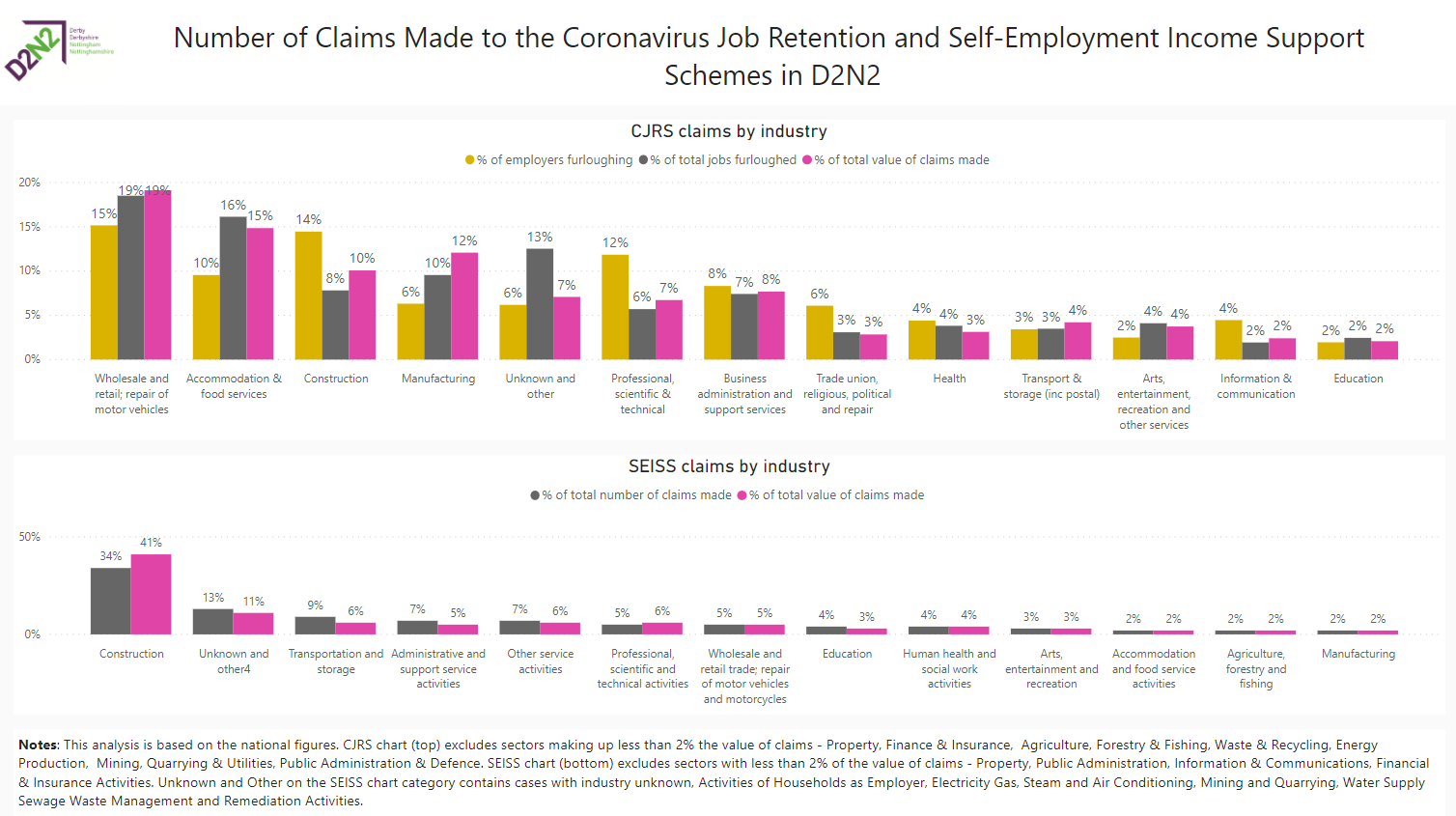

Sectors with most CJRS clams are Wholesale and Retail (19%), Accommodation and Food services (16%) and Manufacturing (10%).

In terms of the self-employed claims, the construction sector accounted for a third of the total claims.

A more detailed analysis by Local Authority district is available here.

4. High Growth Businesses

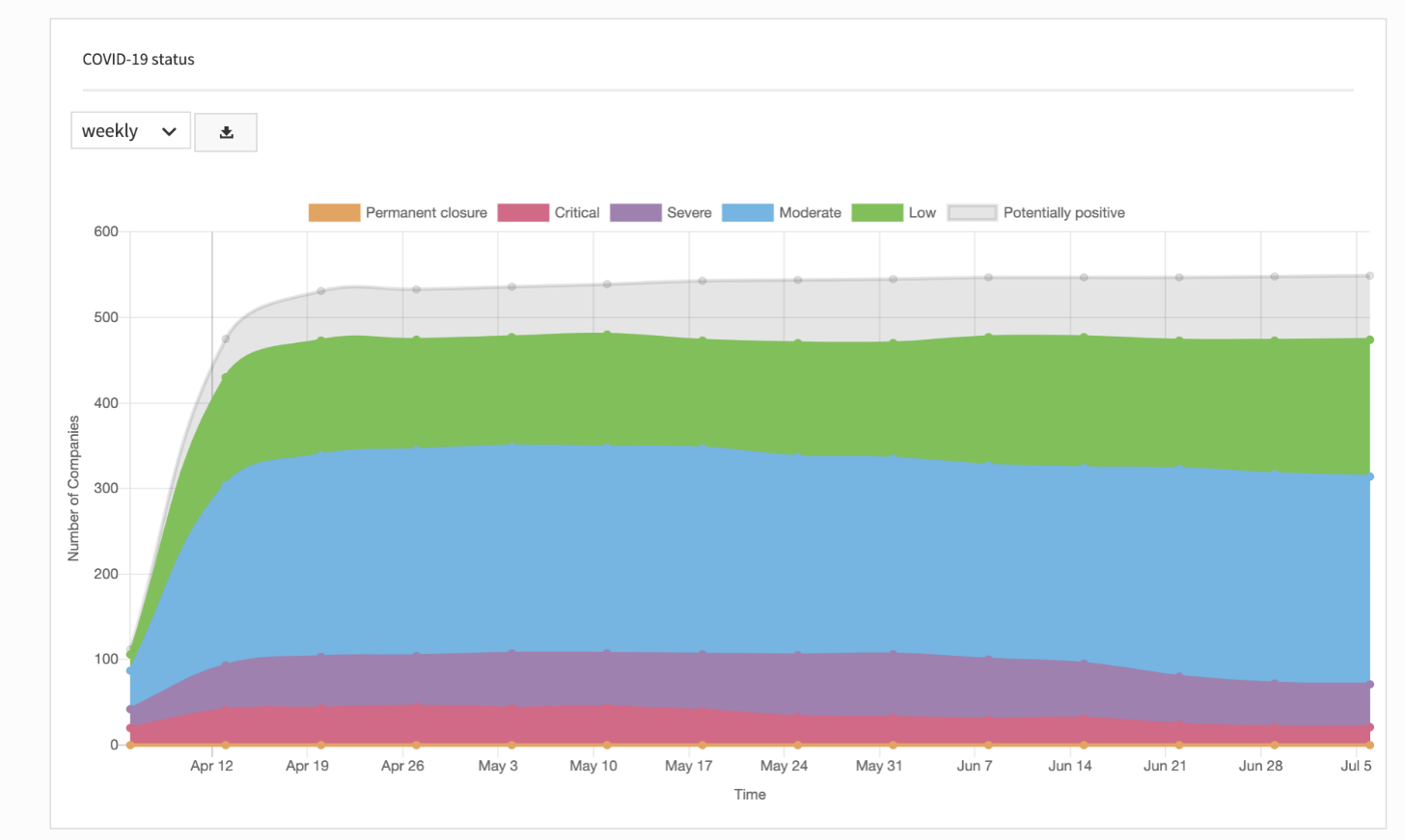

Data published by Beauhurst show that the number of businesses identified as having critical status because of the virus has declined slightly since mid-June and a higher proportion of businesses are experiencing moderate to low effects.

5. Education and Skills

The Department for Education (DfE) has published guidance on the safe reopening of FE colleges and training providers from the start of the Autumn 2020 term.

The guidance explains the steps that will need to be taken to enable the full reopening of learning environments for both adults and young people from September.

The full guidance is available here.

6. Overview of the Midlands (via Midlands Engine Economic Observatory)

In 100 days since lockdown, the Bank of England has suggested the UK economy is heading for a V-shaped recovery.

This is based on a return of consumer spending, a trade deal and return of trade activity, no second waves of lockdowns, a vaccine by mid next year, and a return to ‘normal’ late 2021.

June’s Markit Purchasing Managers Indices (PMIs) show a marked improvement in national outlook, returning to near pre-lookdown levels, below February levels but near-February.

Registering at below 50 (47.6) indicates the economy has contracted and comparing on a month-on-month basis suggests the UK economy contracted in June, but not by as much as it did in the previous months.

Applying the national proportions of workers furloughed per sector to the Midlands Engine furlough numbers (1.19m people) suggests a number of sectors at risk including the Visitor Economy sector which potentially has the highest number of workers furloughed – 242,041 workers (65.4% of jobs in this sector).

The local lockdown in Leicester is likely to bear heavily on businesses that incurred significant costs in preparation for the anticipated opening of additional sectors on the 4th of July.

The flexibility to return workers affected by the lockdown to furlough is welcome, but additional financial support is likely to be required if this circumstance is not to result in additional business failures.

There is the risk that Leicester-based businesses unable to trade will lose business to competitors based outside the lockdown.

Regional analysis from the Business Impact of Coronavirus shows that 69% of trading businesses in the West Midlands and 64% in the East Midlands reported their turnover had decreased by at least 20% compared to 65% of businesses in the UK.

However, 16% of trading businesses in the West Midlands and 19% in the East Midlands reported that their turnover was unaffected (22% for the UK) and just over 10% reported their turnover had increased by at least 20% in the West Midlands and nearly 12% for the East Midlands, above the UK average (nearly 9%).

The Small Area Vulnerability Index (SAVI) investigates the association between each predictor (proportion of the population from Black, Asian and Minority Ethnic (BAME) backgrounds, income deprived, over 80 years old, living in care homes, living in overcrowded housing and having been admitted in the past 5 years for a chronic health condition) and COVID19 mortality using a multivariable Poisson regression, whilst accounting for the regional spread and duration of the epidemic.

There are high levels of vulnerability concentrated around the Midlands Engine particularly in the West Midlands with high scoring clusters in Wolverhampton, Shropshire, Birmingham, Bromsgrove, Rugby, Herefordshire, and Stratford-on-Avon whilst in the East Midlands there were smaller clusters around Derby, Chesterfield and Nottingham.

According to Make UK, manufacturing is expected to decline by 11% nationally, creating a decline of between £19bn (baseline forecast) and £35bn (downside forecast) losses.

They predict manufacturing investment to also be down between 1% and 9.7%.

It is a major concern that manufacturing sectors identified as amongst the Region’s strongest performers in advance of the Pandemic– such as automotive and aerospace – are now amongst the most threatened.

FULL PRESENTATION: MIDLANDS ENGINE ECONOMIC IMPACT OF COVID-19 (3 JULY 2020)