Welcome to the third edition of the D2N2 Economic Recovery Report.

This report pulls together information from across the region to understand the impact of Covid19 on our economy.

For previous editions of the D2N2 Economic Recovery Report, please see the D2N2 Data Centre.

D2N2 Economic Recovery Report – August 2020

As part of its response to the Coronavirus, D2N2 is producing data reports examining how the Coronavirus pandemic has affected the local economy.

The report has been produced in collaboration with the University of Derby, the University of Nottingham, and Nottingham Trent University.

This latest report focuses on several key areas:

- D2N2 Economic Recovery Analytics Group

- D2N2 Economic Risk and Recovery Dashboard

- D2N2 Growth Hub Survey Findings

- Unemployment Benefit Claimants

- Coronavirus Job Retention Scheme and Self Employment Claims

- D2N2 Redundancy and Redeployment Triage Service

- High Growth Businesses

- Government Incentives: Education and Skills

- Apprenticeship Guidance

- Education: Updated Guidance

- Midlands Engine Overview

A PDF version of this D2N2 Economic Recovery Report is available for download.

D2N2 Economic Risk & Recovery Dashboard

The Economic Recovery Analytical Group have discussed the first draft of the Economic Risk and Recovery Dashboard below:

The dashboard contains snapshot estimates of unemployment and GVA estimates, and data on claims to furlough schemes. It also contains trends in unemployment benefit claims, job postings, business closures, and insight from the Growth Hub Survey on redundancies and severe decline in sales.

D2N2 Economic Recovery Analytical Group

The D2N2 Economic Recovery Analytical Group (AG) is drawn from the region’s universities, colleges, local authorities and business groups together with colleagues from Government. It undertakes pro bono research and analysis to support planning and delivery by the LEP and the Derbyshire and Nottinghamshire Local Resilience fora.

The AG supports the work of our Economic Recovery Board, which leads the revision of our Local Industrial Strategy to become a Recovery and Growth Strategy. Recent AG work has included:

- Analysis of Covid-19’s sectoral impact and employment – currently being updated

- Covid-19’s impact on occupational classes: Data online

- Unemployment: Data online

- Recommending to local partners and government the creation of a youth employment and skills offer

Key tasks will now include:

- Ensuring that recent government announcements, for example, the Kickstart Fund, are targeting where they will have the most effect in our region.

- Providing advice on the development of the local level economic recovery plans commissioned by the LRFs.

- Developing a suite of economic indicators to help us monitor the progress of the recovery.

D2N2 Growth Hub Survey Findings

Working alongside business representative organisations and local authorities, a consolidated survey has allowed the collection of standardised business data to inform recovery planning. By 25 July, 794 business had responded to the D2N2 Growth Hub Survey.

- 97% of businesses said Covid-19 was affecting their business, the overwhelming majority in a negative way

- 71% of respondents furloughed staff, and 6% made staff redundant

- 72% of respondents have experienced over 50% decline in sales.

The results will now serve as a baseline and a new version of the survey will be issued shortly.

D2N2 Redundancy and Redeployment Triage Service

The triage service was put in place in collaboration with the National Careers Service to coordinate support for individuals at risk of redundancy due to COVID-19.

This service supports people who directly refer or are referred by their employers rather than through traditional employment support or DWP routes.

Engagement to date is summarised below:

- Total number individual enquiries to date = 411

- Numbers referred, given advice or referred = 382

- Employment outcomes or reasons for lack of redeployment outcome = 103 employment outcomes, 68 progressed into learning and 11 progressed in current employment

- Number of business enquiries (for recruitment or redundancy) and actions taken = 15 directly through the Triage Service with further referrals through CBI and Business Development Team.

Trends currently seen through this service include an increasing number of 18-24 over the last 2-3 weeks and a significant increase in the levels of redundancy support work referred directly to the service from Job Centre Plus.

Government Incentives: Employment and Skills

The government recently published Plan for Jobs including up to £30bn to support job retention, increase apprenticeships, access to high demand skills; and stimulate job retention and recovery in the hardest-hit sectors. The key components include:

- Kickstart Scheme, creating high-quality work placements for young people and those at risk of long-term unemployment;

- Additional careers and employment support through Job Centre Plus and the National Careers Service

- Cash incentives for employers recruiting apprentices

- Expansion of traineeship and FE learning provision- aligned to key sector and skills needs

For more information see the latest summary from the Department for Work & Pensions and the Department for Education.

Unemployment Benefit Claimants

Based on the Universal Credit and Job Seeker’s Allowance statistics, there were 80,050 claimants in June 2020. This was 128% up from last year (June 2019) and a 1.4% down from last month (May 2020), compared to the average UK increase of 131% and 1.3% decrease, respectively.

- Despite the higher growth compared to the same period last year, claimants as a percentage of the working-age population (16-64) are slightly lower in D2N2 (5.9%) than nationally (6.3%)

- Derbyshire Dales, South Derbyshire, Rushcliffe, and High Peak are reporting significantly higher on year increases. However, these areas have a lower number of claimants compared to other areas.

Coronavirus Job Retention Scheme and Self Employment Claims

Based on HMRC data, there were 305,100 Corovavirus Job Retention Scheme (CJRS) and 73,500 Self-Employment Income Support Scheme (SEISS) claims made as of June 30. This makes up approximately 34% of all people in employment, compared to 30% in May.

- The highest proportion of employment is in High Peak (38%) and Chesterfield (37.4%) and the lowest in Rushcliffe (28.9%), Broxtowe (31.8%) and Amber Valley (32%)

- The largest increase in percentage terms was in Public Admin & Defence (173%, but from a low base of 131 claims in May) and Education (52% increase from 6,400 in May)

- Trade, Accommodation & Food and Manufacturing services account for the largest proportion of jobs furloughed (19%, 17% and 10% respectively)

- Construction remains the largest sector for self-employment income support claims reaching almost 25,000. The sector accounts for 34% of all self-employment claims, and 41% in value terms. Administrative and Support Services saw a 21% increase in the June figures.

More detailed analysis by Local Authority is available here.

High Growth Businesses

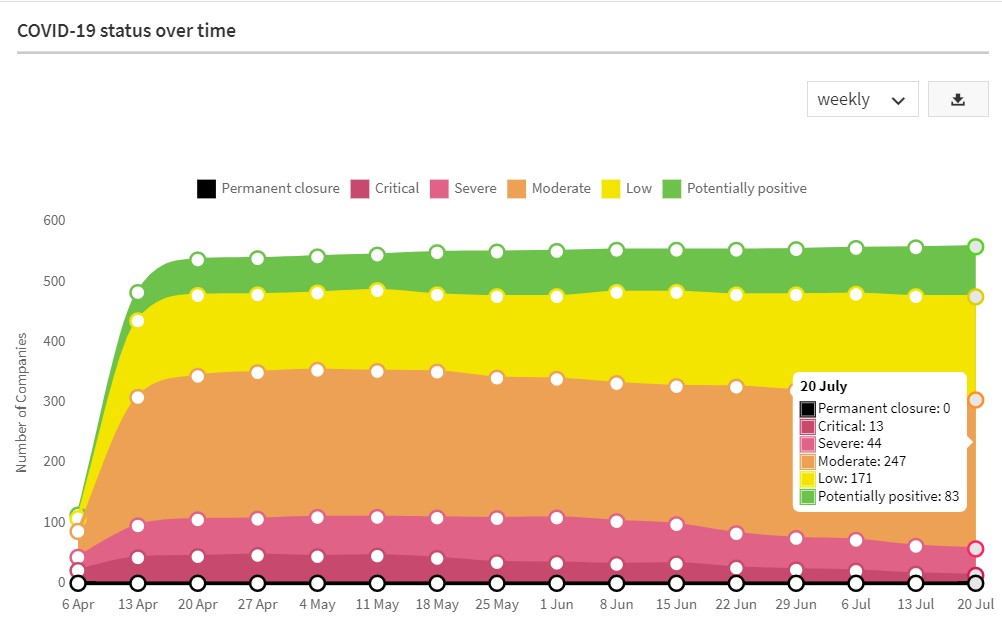

Beauhurst, a searchable database of the UK’s high-growth companies, have assessed and tagged 558 companies in D2N2 based on information published on company websites and social media channels. The tags were grouped into the following categories:

- Potentially positive impact (Green): A company that can potentially grow its operations as a result of these circumstances

- Low impact (Yellow): A company that will be able to largely continue normal operations, albeit possibly with safety measures such as working from home in place

- Moderate impact (Orange): Company that has suffered disruption beyond mere inconvenience but is mostly able to continue operations

- Severe impact (Pink): Company that has suffered serious disruption to its ability to operate

- Critical impact (red): Company that is facing an existential threat to its ability to continue in operation

- Permanent closure (Black): A company that has definitively ceased trading as a result of COVID-19.

Beauhurst data suggests that circa 10% of businesses are experiencing critical or severe negative impact. This is down from 20% at its peak in May. The data shows 15% of businesses may be experiencing potentially positive effects.

Apprenticeship Guidance

Version 6 guidance for Apprenticeships in England has now been published. The revised guidance provides greater clarity for providers and employers on:

- Re-opening educational settings. From September, there will be no limits on apprentices, at any age, attending on-site delivery

- Universal Credit for apprentices

- A future launch of a support service for redundant apprentices

- The Level 2 suspension of the rule on Functional Skills assessments extended until 31 December 2020

- Further FAQs covering apprentices starting with a new employer

Education: Updated Guidance

Following the closure of schools for the summer break, the Department for Education has issued guidance for parents and carers who want or need to use out of school provision. The guidance includes an assessment of appropriate premises to be used and indicates what sort of activities parents and carers can expect could be provided safely.

Overview of the Midlands (via Midlands Engine Economic Observatory)

UK GDP grew 1.8% in May but was still 24.5% below its level in February, before the plunge in economic output when the pandemic struck.

Manufacturing and house building indicated some signs of recovery as some businesses saw staff return to work during May, but whilst retail sales rose, it was mostly confined to online shopping, due to restrictions on non-essential retail still being in place.

The Office for Budget Responsibility (OBR) said the economy was on course to shrink by 12.4% in 2020, with borrowing set to rise to a peacetime high.

The fiscal watchdog warned that the economy would not get back to its pre-crisis size until the end of 2022, while unemployment was likely to rise to a record 12% by the end of this year, falling back to 10.1% in 2021.

The latest figures from the survey of the Purchasing Managers Index for the Business Activity Index shows a substantial change in a positive direction.

The Business Activity Index for the WM was 50.4 in June 2020 (UK = 47.7) compared to 27.9 in May.

Similarly, the EM reported a figure of 50.4 in June 2020 compared to 32.6 in May.

This signals a rise back to similar levels reported in May 2019 – 50.7 in the West Midlands and 49.6 for the East Midlands.

Across the 12 regions, the East and West Midlands regions were the only 2 regions in the UK who saw an increase in business activity in June.

Across the Midlands Engine area, 1,404,100 workers were furloughed in June 2020, this is an increase of 208,400 (17.4%) of workers compared to May 2020.

Across the Midlands region, the highest sector for the number of workers furloughed in June 2020 was in retail sector at 20.9% (307,900) which is above the national average of 20.1%.

In June 2020 there were 416,605 claimants aged 16 years and over in the Midlands Engine.

This has decreased by 3,975 claimants since May 2020 (-0.9%, UK -1.3%). However, there are 195,065 (+88.0%, UK +107.0%) more claimants when compared to March 2020.

The number of claimants as a percentage of residents aged 16 years old over was 5.0% in June (UK 4.9%).

In June 2020 there were 86,510 claimants aged 16-24 years old in the Midlands Engine. This has increased by 2,365 claimants since May 2020 (+2.8%, UK +3.6%).

There are 42,315 (+95.7%, UK +116.0%) more youth claimants when compared to March 2020. The number of claimants as a percentage of residents aged 16–24 years old was7.4% in June (UK7.3%).

Regional analysis from Wave 7 of the Business Impact of Coronavirus Survey shows that 45% of trading businesses in the West Midlands and 43% of East Midlands businesses reported their turnover had decreased by at least 20% (UK 44%).

However, 17% of trading businesses in the West Midlands and 19% for the East Midlands reported that their turnover was unaffected (21% for the UK) and 10% reported their turnover had increased by at least 20% in the West Midlands, whilst the figure was nearly 11% for the East Midlands, above the UK average(8%).

There were 242 Foreign Direct Investment (FDI) projects across the Midlands in April 2019- March 20 (pre-Covid-19), this is an increase of 8.0% (+18 projects) compared to 2018-19.

The UK increased by 3.9% (+70 projects), from 1,782 in 2018-19 to 1,852 in 2019-20.