Welcome to the fourth edition of the D2N2 Economic Recovery Report.

This report pulls together information from across the region to understand the impact of Covid-19 on our economy.

For previous editions of the D2N2 Economic Recovery Report, please see the D2N2 Data Centre.

D2N2 Economic Recovery Report – September 2020

As part of its response to the Coronavirus, D2N2 is producing data reports examining how the Coronavirus pandemic has affected the local economy.

The report has been produced in collaboration with the University of Derby, the University of Nottingham, and Nottingham Trent University.

This latest report focuses on several key areas:

- D2N2 Economic Recovery Analytics Group

- D2N2 Economic Risk and Recovery Dashboard

- D2N2 Growth Hub Survey Findings

- Covid-19s Local Economic Impact on Nottingham

- Unemployment Benefit Claimants

- Income Support Scheme Claims

- Impact on High Growth Businesses

- Education and Skills

- Government Incentives for Employment and Skills

- Apprenticeships – Employer Incentives and Support

- KickStart Scheme

- Reopening Schools

- Midlands Engine Overview

A PDF version of this D2N2 Economic Recovery Report is available for download.

D2N2 Economic Risk & Recovery Dashboard

The Economic Risk and Recovery Dashboard has been updated as a result of feedback from the D2N2 Economic Recovery Analytical Group.

The dashboard contains snapshot estimates of unemployment and GVA estimates, and data on claims to furlough schemes. It also contains trends in unemployment benefit claims, job postings, business closures, and insight from the D2N2 Growth Hub Survey on redundancies and severe decline in sales.

D2N2 Economic Recovery Analytical Group

The D2N2 Economic Recovery Analytical Group (AG) is drawn from the region’s universities, colleges, local authorities and business groups together with colleagues from Government. It undertakes pro bono research and analysis to support planning and delivery by the LEP and the Derbyshire and Nottinghamshire Local Resilience fora.

The AG supports the work of our Economic Recovery Board, which leads to the revision of our Local Industrial Strategy to becoming a Recovery and Growth Strategy. Key tasks now include:

- Revising our analysis of Covid-19’s sectoral impact and employment: Full first report

- Ensuring that recent government announcements, for example, the Kickstart Fund, are targeting where they will have the most effect in our region.

- Providing advice on the development of the local level economic recovery plans commissioned by the LRFs.

- Developing a suite of economic indicators to help us monitor the progress of the recovery

- Working with the Emergent Alliance to develop tools to enable real-time tracking of the impact of Covid-19 and enhancing our ability to forecast future impacts

D2N2 Growth Hub Survey Findings

Working alongside business representative organisations and local authorities, a consolidated survey has allowed the collection of standardised business data to inform recovery planning. By August, 800 business had responded to the D2N2 Growth Hub Survey.

- 97% of businesses said Covid-19 was affecting their business, the overwhelming majority in a negative way

- 71% of respondents furloughed staff, and 6% made staff redundant

- 72% of respondents have experienced over 50% decline in sales.

A more detailed analysis of the data is available here.

Income Support Scheme Claims

Based on HMRC data, there were 305,100 Corovavirus Job Retention Scheme (CJRS) and 73,500 Self-Employment Income Support Scheme (SEISS) claims made as of June 30.

This makes up approximately 34% of all people in employment, compared to 30% in May.

- The highest proportion of employment is in High Peak (38%) and Chesterfield (37.4%) and the lowest in Rushcliffe (28.9%), Broxtowe (31.8%) and Amber Valley (32%);

- The largest increase in percentage terms was in Public Admin & Defence (173%, but from a low base of 131 claims in May) and Education (52% increase from 6,400 in May);

- Trade, Accommodation & Food and Manufacturing services account for the largest proportion of jobs furloughed (19%, 17% and 10% respectively);

- Construction remains the largest sector for self-employment income support claims reaching almost 25,000. The sector accounts for 34% of all self-employment claims, and 41% in value terms. Administrative and Support Services saw a 21% increase in the June figures.

More detailed analysis by Local Authority is available here.

Education and Skills

The region’s employers should continue to invest in their workforce and consider their ability to use current government incentives to support opportunities for young people, who will otherwise be hardest hit by COVID 19. This will potentially lead to long-lasting impacts on the future labour market.

Covid-19s Local Economic Impact on Nottingham

The Coronavirus pandemic and the public health measures adopted in response is impacting the national, regional and local economy in three important ways: disruption to the supply of goods and services; demand shocks; and increased uncertainty.

This report explores the impact at a local level for Nottingham City.

Unemployment Benefit Claimants

Based on the Universal Credit and Job Seeker’s Allowance statistics, there were 80,785 claimants (July 2020). This was 126% up from last year (July 2019) and 2.1% up from June. This compares to the average UK increase of 131% and 1.3% decrease, respectively.

- Despite the higher growth compared to the same period last year, claimants as a percentage of the working-age population (16-64) are slightly lower in D2N2 (5.9%) than nationally (6.3%)

- Derbyshire Dales, South Derbyshire, Rushcliffe, and High Peak are reporting significantly higher on year increases. However, these areas have a lower number of claimants compared to other areas.

Impact on High Growth Businesses

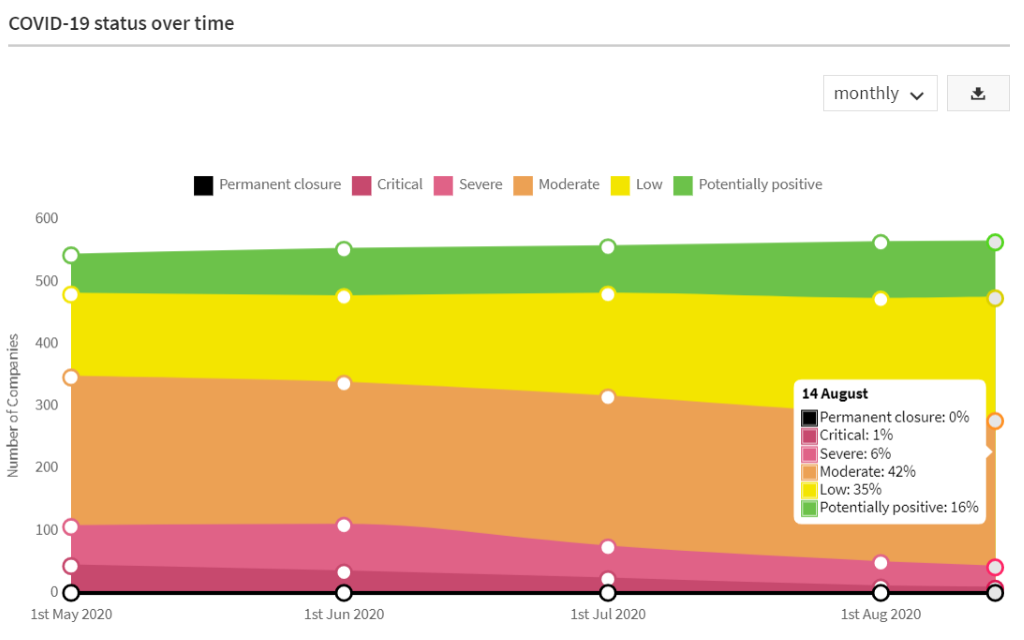

Beauhurst, a searchable database of the UK’s high-growth companies, have assessed and tagged 558 companies in D2N2 based on information published on company websites and social media channels. The tags were grouped into the following categories:

- Potentially positive impact (Green): A company that can potentially grow its operations as a result of these circumstances

- Low impact (Yellow): A company that will be able to largely continue normal operations, albeit possibly with safety measures such as working from home in place

- Moderate impact (Orange): Company that has suffered disruption beyond mere inconvenience but is mostly able to continue operations

- Severe impact (Pink): Company that has suffered serious disruption to its ability to operate

- Critical impact (red): Company that is facing an existential threat to its ability to continue in operation

- Permanent closure (Black): A company that has definitively ceased trading as a result of COVID-19.

The Beauhurst data suggests that 7% of businesses are experiencing critical or severe negative impact. This is down from 20% at its peak in May. The data shows 16% of businesses may be experiencing potentially positive effects.

Government Incentives for Employment and Skills

The government recently published Plan for Jobs including up to £30bn to support job retention, increase apprenticeships, access to high demand skills; and stimulate job retention and recovery in the hardest-hit sectors. The key components include:

- Kickstart Scheme, creating high-quality work placements for young people and those at risk of long-term unemployment;

- Additional careers and employment support through JobCentre Plus and the National Careers Service

- Cash incentives for employers recruiting apprentices

- Expansion of traineeship and FE learning provision- aligned to key sector and skills needs

For more information, see the latest summary from the Department for Work & Pensions and the Department for Education.

Apprenticeships – Employer Incentives and Support

Incentive payments of up to £2,000 are now available to any organisation hiring a new apprentice. To qualify the apprentice must:

- Be new to your organisation

- Start their contract of employment and their apprenticeship with you between 1 August 2020 and 31 January 2021

- More information is available here.

Version 8 of the guidance on the apprenticeship programme response to COVID-19 has been published. This version includes information on:

- Information on the actions that training providers should take for the return of apprentices in September

- As apprentices return to work, assessment centres and educational settings, training providers, employers and EPAOs consider how best to minimise the risks of coronavirus transmission when determining how and when training and assessment take place.

- Updated guidance on workplaces and assessment centres.

- Additional information on local outbreaks, contingencies for outbreaks, and links to the wider FE guidance.

How apprentices who have been made redundant, or who are at risk of redundancy, can access online and telephone support through the Redundancy Support Service for Apprentices.

KickStart Scheme

The Kickstart Scheme is a £2 billion fund to create hundreds of thousands of high-quality six-month work placements for young people.

The Kickstart Scheme can be used to create new 6-month job placements for young people who are currently on Universal Credit and at risk of long-term unemployment. The job placements should support the participants to develop the skills and experience they need to find work after completing the scheme.

Funding is available following a successful application process. Applications must be for a minimum of 30 job placements. If you are unable to offer this many job placements, you can partner with other organisations to reach the minimum number.

If you are a representative applying on behalf of a group of employers, you can get £300 of funding to support the associated administrative costs of bringing together these employers.

Kickstart is not an apprenticeship, but participants may move on to an apprenticeship at any time during, or after their job placement.

Further guidance is available here.

The promotional materials to employers and potential job placement participants can be found here.

Reopening Schools

Government intention is for all pupils, in all year groups, to return to school full-time from the beginning of the autumn term.

To support this, guidance has been published for both mainstream and alternative provision.

Overview of the Midlands (via Midlands Engine Economic Observatory)

The Nasdaq 100 index had its best gain in three months to close at a record high in July.

The lockdown and stay-at-home order drove a rise in the FAANG group of megacap technology companies (Facebook, Amazon, Alphabet, Apple and Netflix) while Zoom Video Communications Inc. also gained.

The main beneficiaries of the lockdown have been technology companies, evident in the recent gains made by such tech companies on the stock markets.

Andy Haldane, the Bank of England’s chief economist has said that the economy has recovered half the output lost during lockdown.

He told the Treasury Select Committee this week that the economy had experienced a bounce-back in activity, with almost half the quarter’s plunge in output experienced during March and April clawed back. He maintained that the recovery is following a V shape.

Following the responses to the Bank of England’s Decision Maker Panel (DMP) survey, analysis indicates that the Midlands could lose around 517,000 private sector employees by 2020 Q4 – the trough of the expected employment effect.

The biggest impact in absolute terms is forecast in the wholesale & retail sector, followed by accommodation & food and admin & support.

The analysis also predicts that by 2020 Q4, there could be a reduction in employment of 10.4% on average across all Midlands LEP areas, with little variance.

This reduction is expected to be greater in certain local authorities within the LEPs including East Lindsey and Derbyshire Dales showing the largest per cent decline in employment of 12.3% and 11.7% respectively.

Regional analysis from the Business Impact of Coronavirus shows that between 29th June – 12th July 2020, 90.3% of responding West Midlands and East Midlands businesses are currently trading and have been for more than the last two weeks (UK 85.1%).

2.4% of West Midlands businesses and 2.9% of East Midlands businesses started trading within the last two weeks after a pause in trading (UK 3.8%).

3.1% of responding West Midlands businesses and 2.4% of East Midlands businesses have paused trading but intend to restart in the next two weeks (UK 4.3%).

Although, 3.6% of responding West Midlands businesses and 4.0% of East Midlands businesses have paused trading and do not intend to restart in the next two weeks (UK 6.3%).

Across the Midlands Engine, there are over 1.4 million workers currently furloughed – 31.8 % of the workforce.

An economic update from PwC shows that nationally around 17% of furloughed workers are at risk of redundancy.

The sector with the highest proportion of furloughed workers at risk of redundancy is accommodation & food services with 32%.

Make UK’s latest manufacturing monitor indicates furlough activity has largely remained consistent with minimal changes since the previous report.

Approximately 77% of manufacturers have furloughed anywhere between 1% and 50% of staff, with the majority of firms within the 26-50% category.

Reviewing recent research on the revival of towns pre-pandemic and the impact of Covid-19 on places sets out the following broad recommendations for future directions to deal with the economic, physical and mental health of residents and businesses:

- Creative and innovative leadership

- Meaningful community engagement

- Understanding places’ unique selling points

- Competitive, safe socialising and experience

- Let there be light, blue and green infrastructure

- Investment in modern age markets and an environment for independents to thrive

- Reshape ownership and taxation models

- Connectivity which enables high-quality interactions

- Create a place for caring and community